Current Ratio Higher or Lower Better

The moral of the story is that a. What do you think.

/dotdash_Final_How_Is_the_Acid-Test_Ratio_Calculated_2020-01-e78bcddeb1dc41d29bcacaa0072bc773.jpg)

How To Calculate Acid Test Ratio Overview Formula And Example

From the example above a quick recalculation shows your firm now holds.

. Window dressing is the showing of current. Acceptable current ratios vary from industry to industry. I think a higher expense ratio is bad.

In general a current ratio between 15 to 2 is considered beneficial for the business meaning that the company has substantially more financial resources to cover its. 100 1 rating 1. It measures the money value of current assets and current liabilities and not the quality of current assets.

The moral of the story is that a very high. Who are the experts. Acceptable current ratios vary from industry to industry.

In many cases a creditor. In the Arvind Case the Quick Ratio would have given a clearer picture. The Quick Ratio would have given a clearer picture.

The current ratio is a number usually expressed between 0 and up that lets a business know whether they have enough cash to service their immediate debts and liabilities. The current ratio is an indication of a firms liquidity. A higher current ratio is generally considered to be better but can a current ratio be too high.

The higher the ratio the more liquid the company is. Can a ratio be too high or too low. All other things being equal creditors consider a high current ratio to be better than a low current ratio because a high current ratio.

In many cases a creditor would consider a high current ratio to. The current ratio is an indication of a firms liquidity. When liquidity increases this is good more assets.

Quick Ratio Cash Cash Equivalents Liquid Securities Receivables Current Liabilities. An efficiency ratio can calculate the turnover. Yes A ratio can be too high or too low because companies should be trying to maintain the ratio within a specific band rather than keeping it too high or.

Current ratio Current Assets Current Liabilities. The efficiency ratio is typically used to analyze how well a company uses its assets and liabilities internally. A better way to interpret the comfort level of working capital is to look at the Quick Ratio.

When solvency increases this is bad more debt. A better way to interpret the comfort level of working capital is to look at the Quick Ratio.

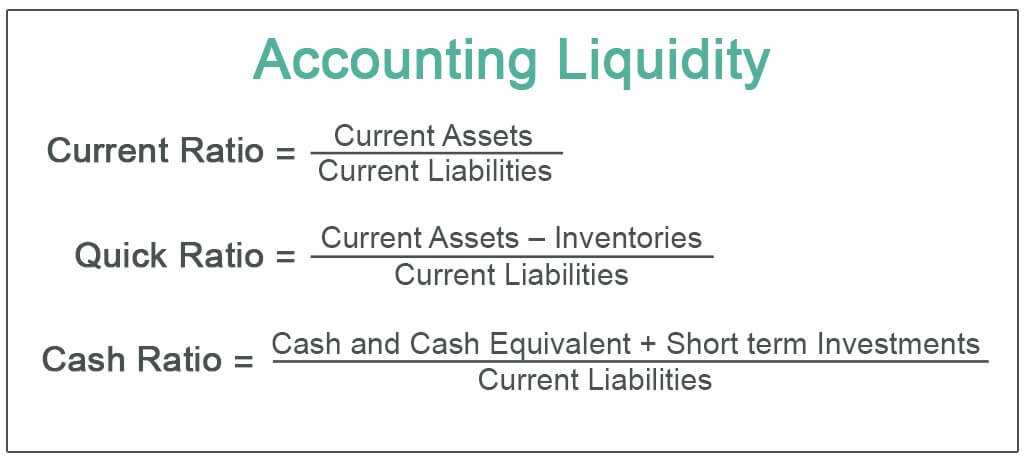

Accounting Liquidity Definition Formula Top 3 Accounting Liquidity Ratio

Acid Test Ratio Vs Current Ratio Formula Comparison Excel Template

Current Ratio Formula And Calculator Excel Template

Acid Test Ratio Vs Current Ratio Formula Comparison Excel Template

Liquidity Ratio Formula And Calculation Examples

/terms-q-quickratio-final-52ee5110fc81457591d8108913ee6250.png)

0 Response to "Current Ratio Higher or Lower Better"

Post a Comment